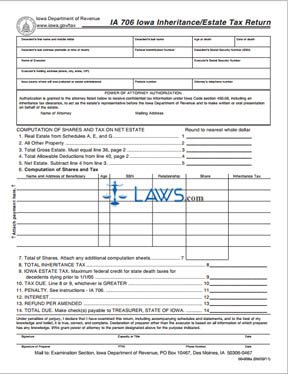

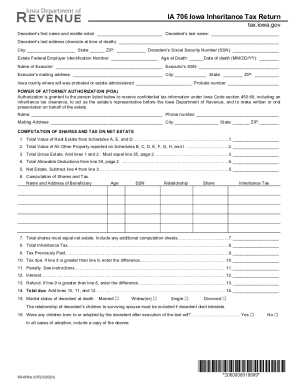

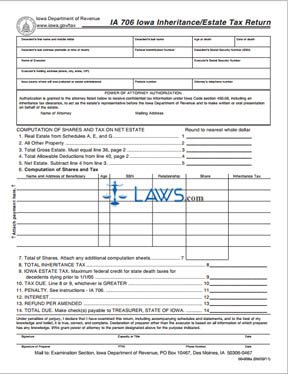

iowa inheritance tax form

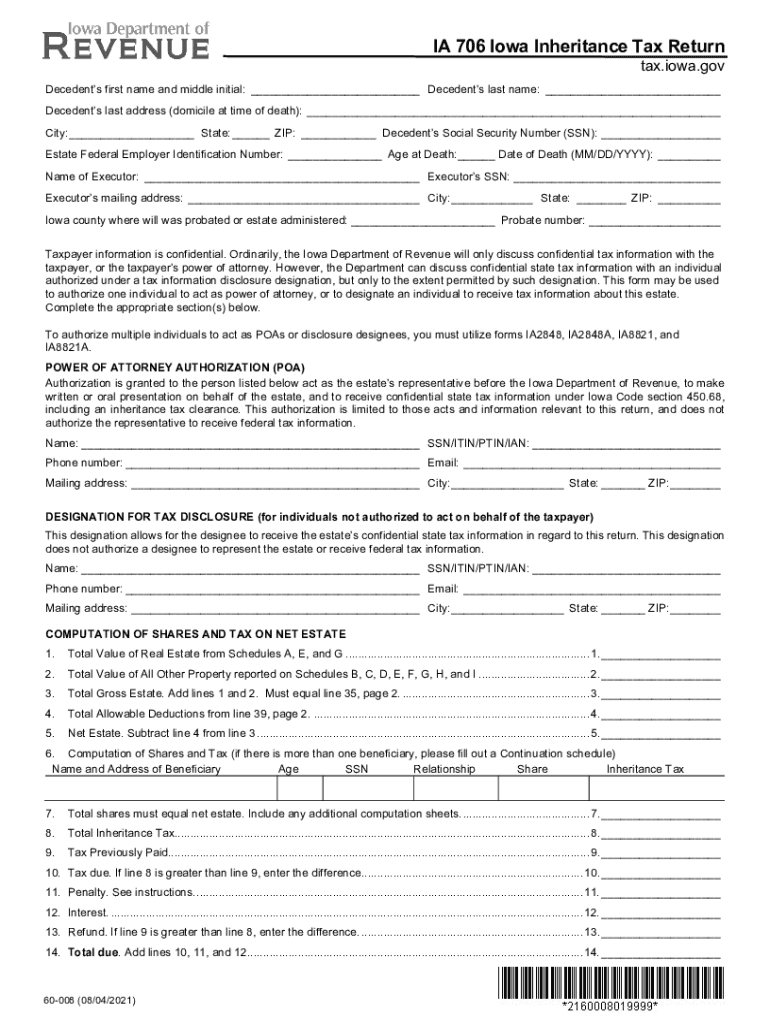

An inheritance tax return must be filed by the fiduciary of any estate when the gross share subjected to tax without reduction for liabilities of any beneficiary heir transferee or surviving joint tenant exceeds the allowable exemption from such share or if a federal return has been filed. Adopted and Filed Rules.

Iowa Inheritance Tax Law Explained

Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

. File a W-2 or 1099. Learn About Sales. 0-12500 has an Iowa inheritance tax rate of 5.

Adopted and Filed Rules. Property in the Estate. Iowa InheritanceEstate Tax Return IA 706.

Enter the decedents name date of death age at the time their address at the time of death and federal identification and Social Security numbers. 0 Fed 1499 State. Report Fraud.

All the beneficiaries of the estate and their respective shares are included on one form IA706. Adopted and Filed Rules. All Will forms may be downloaded in electronic Word or Rich Text format or you may order the form to be sent by regular mail.

Stay informed subscribe to receive updates. Stay informed subscribe to receive updates. Learn About Property Tax.

Quickly Prepare and File Your 2021 Tax Return. Report Fraud. Law.

Read more about Inheritance Tax Application for Extension of Time to File 60-027. Quick steps to complete and eSign Iowa Inheritance Tax Form online. 68 including an inheritance tax clearance to act as the estate s representative before the Iowa Department of Revenue and to make written or oral presentation on behalf of the estate.

In 2021 Iowa decided to repeal its inheritance tax by the year 2025. In the meantime there is a phase-out period before the tax completely disappears. Read more about Inheritance Tax Checklist 60-007.

Iowa Inheritance Tax Schedule F 60-006. Iowa InheritanceEstate Tax - Consent and Waiver of Lien 60-014. Iowa Inheritance Tax Schedule J 60-084.

If you wish to avoid an inheritance tax you can ensure that the net estate is valued at less than 25000. Iowa inheritance tax is a tax paid to the State of Iowa and is based upon a persons beneficiary or heir right to receive money or property that was owned by another person decedent at the time of death and is passing from the decedent to. The following Inheritance Tax rates will apply to a decedents beneficiary who is a.

The document has moved here. Adopted and Filed Rules. Iowa Inheritance Tax Return.

Also Mutual Wills for Married persons or persons living together. Wills for married singles widows or divorced persons with or without children. Use Get Form or simply click on the template preview to open it in the editor.

Up to 25 cash back Update. Change or Cancel a Permit. Register for a Permit.

To pay inheritance and estate tax in the state of Iowa file a form IA 706. Wills include State Specific forms. Inheritance Tax Application for Extension of Time to File 60-027.

Ad We Support All the Common Tax Forms and Most of the Less-Used Forms. Learn About Property Tax. There are also Tax Rate F beneficiaries which are unknown heirs and their tax rate is 5.

Alternatively or in addition you can ensure that the beneficiaries all. Start completing the fillable fields and carefully type in required information. Therefore it is necessary to first.

The inheritance tax return must include a list of the property in the estate and the value of the property along with a list of liabilities or debts and deductions. Anything that is payable to the estate upon death is not included in the calculation of inheritance tax in Iowa and anything payable to a beneficiary such as a life insurance policy is subject to the inheritance tax depending on the. For more on beneficiary designation visit this article.

This document is found on the website of the government of Iowa. Law. File a W-2 or 1099.

Tax Credits. Probate Form for use by Iowa probate attorneys only Read more about Probate Form for use by Iowa probate attorneys only Print. Adopted and Filed Rules.

12501-25000 has an Iowa inheritance tax rate of 6. Iowa InheritanceEstate Tax Return IA 706 Step 1. Inheritance Tax Checklist 60-007.

Brother sister son-in-law daughter-in-law of the decedent. The inheritance tax rate for Tax Rate B beneficiaries ranges from 5 to 10 and the inheritance tax rate for Tax Rate C beneficiaries ranges from 10 to 15. Learn About Sales.

Get and Sign Iowa Department Of Revenue Ia 706 Iowa Inheritanceestate 2020-2022 Form Granted to the person listed below to receive confidential tax information under Iowa Code section 450. What is Iowa inheritance tax. For deaths in 2021-2024 Iowa will reduce the estate tax rate by an additional 20 each year until the tax is fully phased out.

See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611. Track or File Rent Reimbursement. Report Fraud.

Ad Download Or Email IA 706 More Fillable Forms Register and Subscribe Now. Tax Rate D and Tax Rate E beneficiaries are for various types of organizations. From Simple to Advanced Income Taxes.

The rate is determined by the amount of the inheritance received and range from anywhere between 5 and 15. An inheritance tax is only imposed against the beneficiaries that receive property or money from the decedent. The Iowa Inheritance Tax is filed using form IA706 which can be downloaded from the Iowa State Department of Revenue website at wwwiowagovtaxformsinherithtml.

Tax Credits. General Instructions for Iowa Inheritance Tax Return IA 706 Return Required.

2021 Form Ia Dor 706 Fill Online Printable Fillable Blank Pdffiller

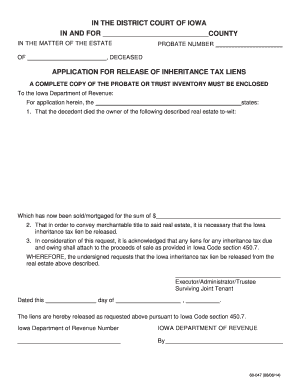

Form 60 047 Application For Release Of Inheritance Tax Lien

Fillable Online Iowa Inheritance Application For Release Form 60 047 Fax Email Print Pdffiller

Free Form Ia 706 Iowa Inheritance Estate Tax Return Free Legal Forms Laws Com

Iowa Law Relating To Collateral Inheritance Tax A Complete Compilation Of The Iowa Statutes Relating To Collateral Inheritance Tax With Annotations From The Courts Of Iowa And New York

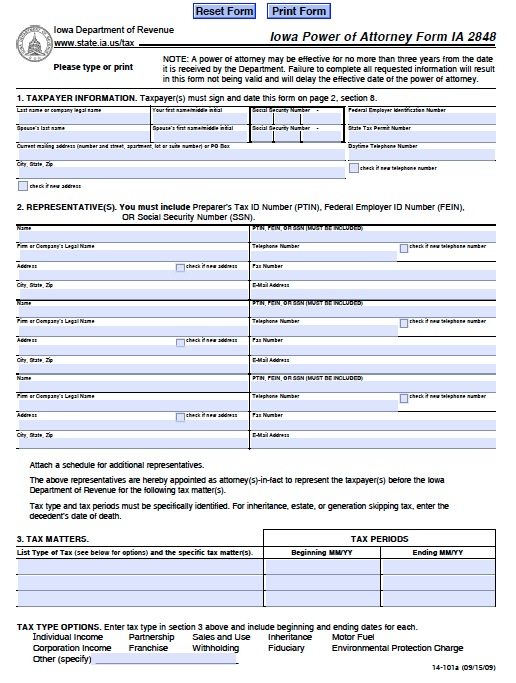

Free Tax Power Of Attorney Iowa Form Ia 2848 Adobe Pdf

Complete The The Estate Settlement Processag Decision Maker Iowa State Form And Sign It Electronically

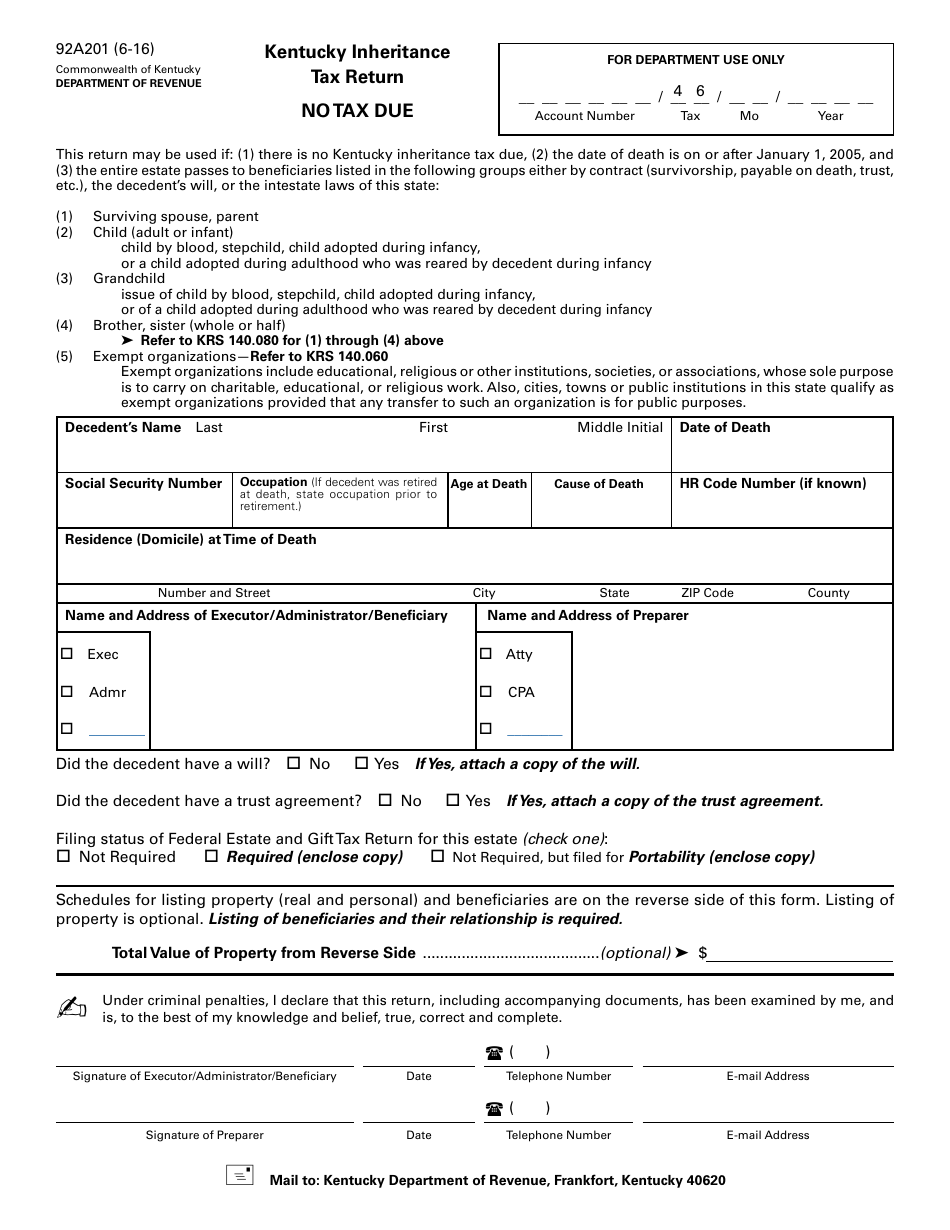

Form 92a201 Download Printable Pdf Or Fill Online Kentucky Inheritance Tax Return No Tax Due Kentucky Templateroller

2021 Form Ia Dor 706 Fill Online Printable Fillable Blank Pdffiller

Iowa 706 Schedule J Fill Online Printable Fillable Blank Pdffiller

Selected Digitized Books Available Online Inheritance And Transfer Tax Library Of Congress